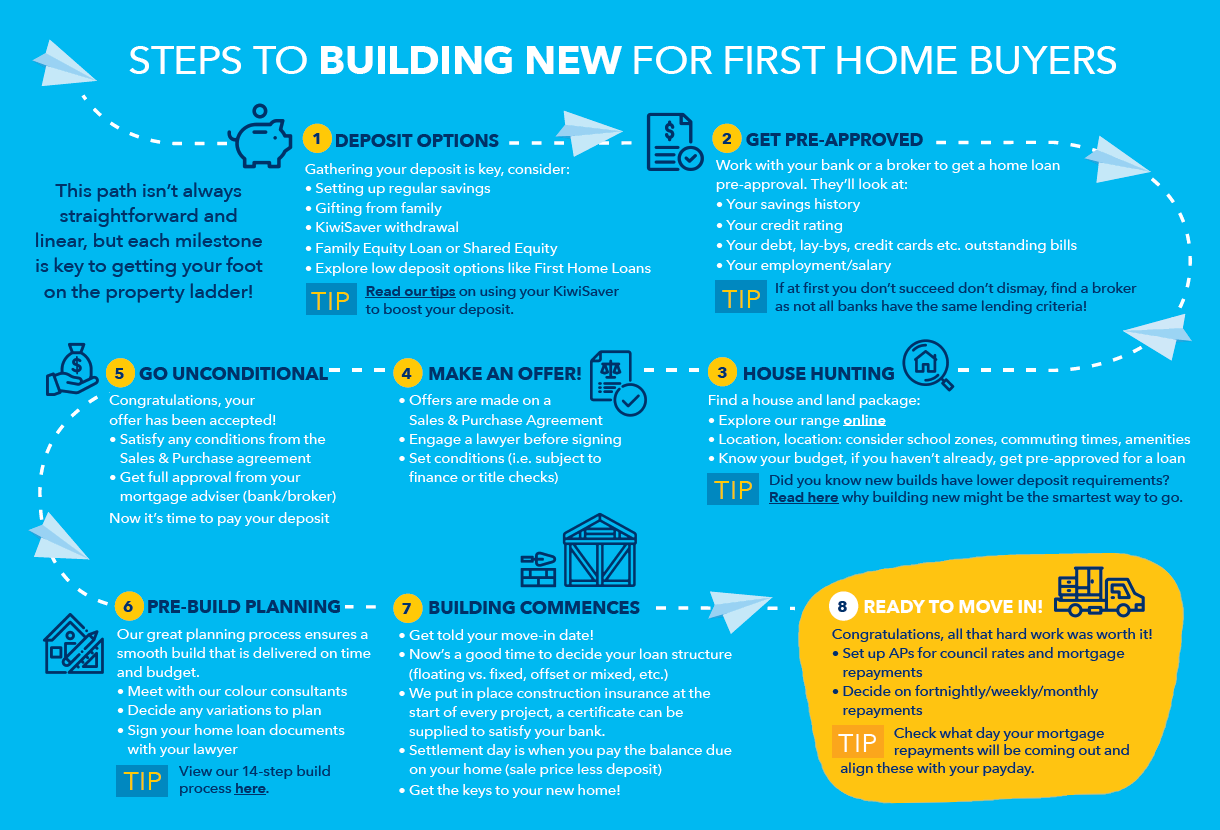

This path isn’t always straightforward and linear, but each milestone is key to getting your foot on the property ladder! Scroll down for each step or check out our visual map:

Download your free PDF guide: Steps to building new for first home buyers

1. DEPOSIT OPTIONS

Gathering your deposit is key, consider:

Tip: Read our tips on boosting your deposit

2. GET PRE-APPROVED

Work with your bank or a broker to get a home loan pre-approval. They’ll look at:

Tip: If at first you don’t succeed don’t dismay, find a broker as not all banks have the same lending criteria!

3. HOUSE HUNTING

Find a house and land package:

Tip: Did you know new builds have lower deposit requirements? Read here why building new might be the smartest way to go.

4. MAKE AN OFFER!

5. GO UNCONDITIONAL

Congratulations, your offer has been accepted!

6. PRE-BUILD PLANNING

Our great planning process ensures a smooth build that is delivered on time and budget.

Tip: View our 14-step build process here.

7. BUILDING COMMENCES

8. READY TO MOVE IN

Congratulations, all that hard work was worth it!

Tip: Check what day your mortgage repayments will be coming out and align these with your payday.

Download your free PDF guide: Steps to building new for first home buyers.